The Unexpected Impact of the NYSE’s Daily Rhythm on Your Wealth

2 min read

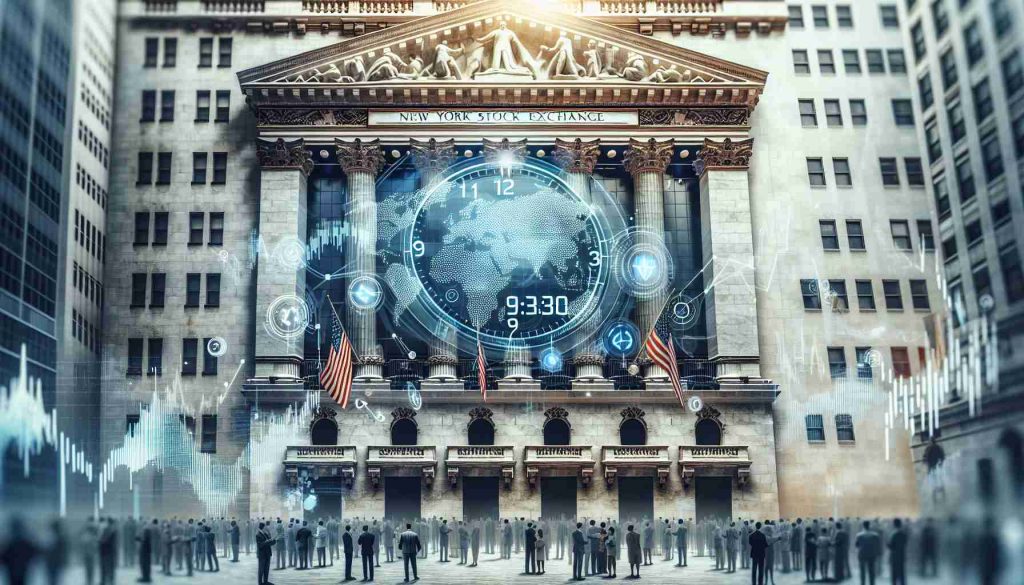

Every weekday morning at 9:30 AM Eastern Time, the New York Stock Exchange (NYSE) orchestrates the daily drama of global markets. The opening bell doesn’t merely signal the start of trading on Wall Street; it shapes economic landscapes worldwide.

Why Is the Opening Bell So Influential?

The beginning of the trading day at the NYSE often mirrors the global economic atmosphere, reacting to pivotal events that occurred during off-hours. European markets, closing just before the NYSE opens, frequently set the stage for U.S. trading strategies. Substantial shifts in indexes like the FTSE or DAX can lead to quick decision-making by traders in New York.

Connecting Wall Street to Main Street

The actions taken immediately after the NYSE opens can ripple down to individuals’ finances. Retirement accounts and pension plans, which rely heavily on stock portfolios, can be directly affected by the day’s market performance—for better or for worse. This connection to the stock market underscores its influence beyond just corporate profits, reaching into personal financial planning.

The Debate Over Market Fairness

A controversial point in stock market operations is the pre-market and after-hours trading, which some critics say favors institutional investors. These sessions enable savvy, well-equipped traders to react to new data and regulatory announcements, possibly sidelining individual investors. Whether technological advancements or regulatory reforms could level this playing field is an ongoing topic of debate in financial circles.

Delve deeper into how early trading decisions affect global finance at the NYSE’s website.

Source: What Time Does the New York Stock Exchange Open and Why Does It Matter?