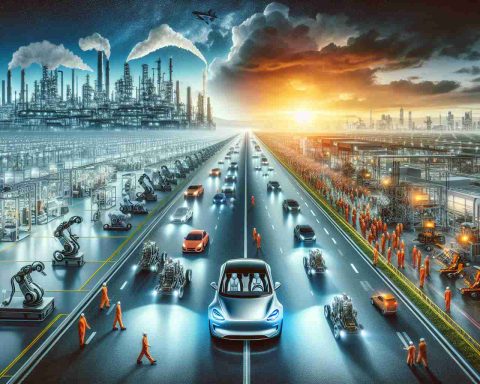

- Germany’s automotive industry, including brands like Volkswagen, BMW, and Mercedes-Benz, faces a notable decline in production and sales.

- In 2023, Volkswagen’s Wolfsburg plant produced 490,000 cars, down from its potential capacity of 870,000.

- National car production fell from 5.65 million units in 2017 to 4.1 million in 2023.

- Sales for German brands are decreasing; Volkswagen sales dropped from 10.7 million in 2017 to 9.2 million in 2023.

- The transition to electric vehicles is costly and faces challenges, including reduced market traction and halted subsidies, which cut electric car sales by 27% in 2023.

- The car industry is pressured by high labor costs and the need to comply with European emissions mandates.

- German automotive companies must adapt and innovate strategically to regain global leadership.

Germany, once a titan of automotive prowess, finds itself sputtering in the fast lane. The nation’s legendary brands—Volkswagen, BMW, and Mercedes-Benz—have become hallmarks of precision and innovation, vehicles of a post-war economic miracle. But the engines are silent in Wolfsburg, home to Volkswagen’s monolithic plant, now producing nearly half of its full capacity.

Wolfsburg, a phoenix from post-war rubble, arose as a car-centric city, its identity interwoven with that of Volkswagen. Yet, the sprawling factory, capable of churning out 870,000 cars annually, crafted just 490,000 in 2023. This decline echoes nationwide; Germany’s car production plummeted from 5.65 million units in 2017 to 4.1 million in 2023.

Economic woes gnaw at the industry. German brands are witnessing dwindling sales—Volkswagen, for instance, dipped from 10.7 million sales in 2017 to 9.2 million. The electric revolution, once a beacon of future prosperity, demands hefty investments yet struggles with market traction.

Beyond innovation, external pressures mounted. The diesel emissions scandal of 2015 forced an urgent pivot to electric models, aligning with European mandates to phase out combustion engines. Despite significant strides, a sudden halt to electric car subsidies in 2023 further jolted the domestic market, slashing electric car sales by 27%.

The cost of doing business here adds to the burden. With some of the highest labor costs in Europe, German manufacturers labor under formidable expenses. Yet, unions steadfastly secure robust pay and benefits, which challenges sustainable adaptation.

Germany’s car industry faces a tough road ahead, but with resilience and strategic pivots, it may yet steer towards a brighter horizon. The mission: to reclaim its status as an undisputed leader on the global automotive stage.

Can Germany’s Auto Industry Reclaim Its Throne Amidst Turbulence?

Germany’s automotive industry, renowned for its top-tier brands like Volkswagen, BMW, and Mercedes-Benz, is facing significant challenges. Although these brands represent engineering excellence and post-war resilience, the industry grapples with various issues. The following sections delve deeper into aspects not covered in the original article, including market trends, pros and cons, future forecasts, and other relevant information.

Market Analysis and Trends

The German automotive industry is currently navigating through a period of transformation, influenced greatly by:

– Electric Vehicle (EV) Transition: The push towards EVs has gained momentum, further accelerated by environmental regulations and changing consumer preferences. Despite the potential, the unexpected removal of subsidies in 2023 has caused a temporary dip in EV sales.

– Digital and Technological Advancements: There is a growing trend of digital integration and technology adoption in vehicles. Autonomous driving, connectivity, and in-car AI systems are becoming focal points.

– Sustainability Initiatives: With increasing attention on reducing carbon footprints, automakers are experimenting with sustainable materials and green manufacturing processes.

Pros and Cons

# Pros:

– Solid Brand Reputation: German auto brands maintain a strong global image, synonymous with durability and luxury.

– Engineering Excellence: The technical expertise and innovation capabilities are significant strengths.

– Rising Demand for EVs Worldwide: Global markets’ increasing demand for electric vehicles represents an opportunity for growth.

# Cons:

– High Operational Costs: Labor costs in Germany are among the highest in Europe, squeezing profit margins.

– Regulatory Pressures: Stringent environmental regulations require costly investments.

– Shifting Global Preferences: Consumer preferences are continuously changing, and competition from international markets is intensifying.

Innovations and Features

The industry is witnessing several innovative breakthroughs, including:

– Advanced Battery Technology: Improvements in battery life and reduction in charging time are focal innovations.

– Autonomous Driving Capabilities: Semi-autonomous features are gradually becoming mainstream.

– Sustainable Manufacturing Process: Use of recyclable materials and eco-friendly manufacturing processes is on the rise.

Predictions and Future Outlook

Future predictions for the German automotive industry include:

– Growth in EV Segment: Despite current setbacks, a strong push for electrification is expected to yield long-term gains.

– Investment in R&D: Increased investments in research and development are crucial to maintain technological leadership.

– Global Expansions: Leveraging brand strength to explore emerging markets could be pivotal.

Challenges and Limitations

The primary challenges the industry faces are:

– Economic Uncertainties: Global economic instability can impact demand and supply chains.

– Adaptation to Rapid Changes: Quick adaptation to new technologies and regulatory standards is required.

– Workforce Dynamics: Balancing union demands with the need for a competitive edge is complex.

Key Questions and Answers

Q: How is the removal of electric car subsidies impacting the market?

A: The sudden halt of subsidies in 2023 led to a 27% drop in domestic electric car sales, highlighting the reliance on government incentives for market growth.

Q: In what ways can German car manufacturers improve competitiveness?

A: By enhancing technological innovation, optimizing cost structures, and expanding globally, manufacturers can bolster competitiveness.

Q: What role does sustainability play in the industry’s future?

A: Sustainability is increasingly critical, as consumers and regulators prioritize eco-friendly practices, driving a shift in production methods.

For further insights into Germany’s automotive industry and global markets, explore these links:

– BMW

– Mercedes-Benz

– Volkswagen

The future of Germany’s automotive sector depends on its ability to innovate, adapt, and strategically navigate shifting market landscapes.