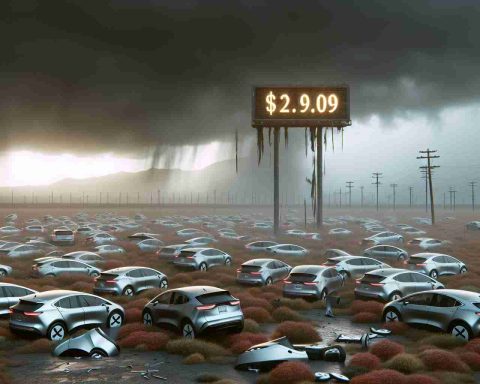

- Hertz’s ambitious push into electric vehicles led to a $2.9 billion loss last year, highlighting the challenges of large-scale EV adoption.

- Key hurdles included high depreciation and daunting repair costs, prompting Hertz to release 30,000 EVs from its fleet.

- CEO Gil West is focusing on strategic realignment towards more reliable models with lower depreciation, such as SUVs and sedans.

- This pivot raises questions about Hertz’s ability to regain fiscal stability amid the growing global trend towards electric vehicles.

- The episode underscores the necessity for companies to balance innovation with practical experience to ensure sustainable progress.

Hertz drove into the future — or so it thought — with an ambitious plunge into electric vehicles. The rental giant envisioned a fleet humming with the silent promise of EVs, ready to define the new era of travel. However, as the tires met the road, reality brought a harsh bump. In its high-speed chase to revolutionize, Hertz encountered an unexpected hazard: skyrocketing depreciation and daunting repair costs.

The rubber hit the road with a staggering revelation of a $2.9 billion loss last year. The bold move now reads more like a cautionary tale, illustrating the turbulent early days of large-scale EV adoption. In a bid to cushion the blow, Hertz released 30,000 EVs from its grip, a testament to the volatility perched atop its enterprise.

As CEO Gil West navigates the aftermath, he emphasizes strategic realignment. The focus shifts from this shimmering yet unpredictable investment to models with consumer-favored reliability and lower depreciation. Picture it: the sleek silhouettes of electric marvels gradually replaced by the familiar, perhaps less glamorous, but steadfast SUVs and sedans, each rental a story of learned lessons and future hope.

Still, a question looms: Can Hertz steer back to fiscal stability with such a pivot? As the world eyes the growing tide of electric transitions, this episode serves as a stark reminder of the hurdles that lie on the road to innovation. Companies must tread with caution, balancing the allure of the new with the wisdom of experience. Hertz bets this recalibration will drive home not just rental cars, but renewed success as well.

Is Hertz’s Electric Vehicle Gamble a Cautionary Tale for the Industry?

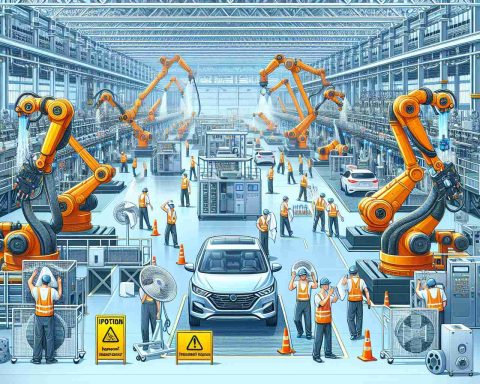

How-To Steps & Life Hacks: Managing EV Fleets

1. Analyze Total Cost of Ownership (TCO): Before investing in electric vehicles (EVs), assess the TCO, including upfront costs, depreciation, maintenance, and charging infrastructure.

2. Understand Depreciation Trends: Electric cars often face faster depreciation due to rapid technological advancements. Stay updated on market data to make informed fleet choices.

3. Focus on Multi-brand Strategy: Avoid relying solely on one EV brand. Diversifying the fleet can mitigate risks if a particular model faces high depreciation or technical issues.

4. Implement Robust Maintenance Protocols: Develop specialized training for service teams to handle unique EV components, potentially reducing repair costs and downtime.

5. Optimize Charging Infrastructure: Invest in a convenient, accessible charging network to support your fleet and improve vehicle turnaround times.

Real-World Use Cases

– Business Travel: EVs can serve shorter, urban trips efficiently, benefiting from lower operational costs. However, they might face challenges in long-distance or rural rentals due to charging station availability.

– Sustainable Tourism: Travelers increasingly value sustainable practices. A strategic focus on hybrid vehicles that balance environmental impact with reliability could appeal to eco-conscious consumers.

Market Forecasts & Industry Trends

The electric vehicle market is expected to grow significantly, with BloombergNEF predicting EVs will comprise 70% of new car sales by 2040. Rental companies must navigate balancing traditional and electric fleets to capitalize on this growth while managing financial risks.

Controversies & Limitations

– Depreciation Concerns: As highlighted by Hertz’s experience, steep depreciation can impact profitability. Companies must weigh these risks against potential long-term savings in fuel and maintenance.

– Maintenance and Repairs: Despite generally lower mechanical complexity, EVs can incur higher repair costs if technicians are not properly trained.

Pros & Cons Overview

Pros:

– Lower Operating Costs: EVs have reduced fuel and routine maintenance expenses.

– Environmental Benefits: They help rental companies market sustainability efforts.

Cons:

– High Depreciation: Rapidly changing technology and a growing inventory affect resale value.

– Infrastructure Challenges: Especially impacts rental operations that require quick turnaround and extended range capabilities.

Security & Sustainability

– Data Security: Incorporate robust cybersecurity measures to protect against vulnerabilities in connected EV systems.

– Sustainability Impact: Despite initial pitfalls, continuing to integrate EVs aligns companies with global initiatives to reduce carbon footprints.

Tips for Readers

1. Research Before Renting or Buying: Understand the EV model’s range and charging options before choosing it for your needs.

2. Price Forecasting Tools: Utilize these tools to analyze potential resale values and depreciation rates, equipping you for smarter investment decisions.

To learn more about electric vehicle adoption and industry trends, visit Hertz or related industry sites. By combining strategic fleet management with industry insights, companies can better navigate the complexities of transitioning to electric vehicles.