- Tesla’s stock has been volatile, driven by rising interest in AI’s role in automotive technology.

- AI enhances Tesla’s Autopilot and Full Self-Driving features, pushing the limits of vehicle autonomy.

- Investors are drawn to AI as a key growth factor for greener, safer transportation solutions.

- The focus on AI might redefine vehicles as intelligent, self-sustaining platforms.

- Tesla’s AI advancements could become a significant influence on its market valuation.

- The intersection of AI and automotive tech positions Tesla at a critical point for future innovation.

- Stakeholders are encouraged to watch and invest in AI-driven transformations in the car industry.

In recent months, Tesla’s stock price has experienced notable fluctuations, influenced by the growing interest in artificial intelligence (AI) and its integration into the automotive industry. As a leader in electric vehicles, Tesla has not only revolutionized the car market but also continues to innovate through cutting-edge technologies. Yet, it is AI that now captivates investors’ attention.

The Intersection of AI and Automotive Technology

Tesla has been utilizing AI in its Autopilot and Full Self-Driving features, pushing the boundaries of what cars can do autonomously. This technology is crucial for future innovation and resonates well with investors who eye greener and safer transportation solutions.

Why the Sudden Interest?

The rise in AI technology’s prominence has fueled Tesla’s stock volatility. Investors are betting on AI being the next significant driver in the automotive sector. Tesla’s proactive approach in integrating AI aligns well with future transportation trends, and investor enthusiasm reflects this. However, as AI’s role becomes more pronounced, the pressure on Tesla’s development timeline increases.

Looking Forward

The company’s strategic focus on AI may redefine how vehicles are perceived, transitioning from mere transportation to intelligent, self-sustaining platforms. As the tech evolves, so will the factors that influence Tesla’s market valuation. With growing AI investments and advancements, Tesla appears positioned at a pivotal point, making its stock a compelling story for investors and technology enthusiasts alike.

Tesla’s journey is far from over; as AI begins to chart the course of the automotive industry, stakeholders are invited to witness—and invest in—what could be the next revolution on wheels.

Unveiling the Future: How Tesla and AI are Redefining Transportation

Emerging Trends and Insights

The intersection of artificial intelligence and the automotive industry, particularly with Tesla, reflects a new era in how we perceive and interact with vehicles. AI’s integration has introduced both opportunities and challenges, which are shaping the market and investor behavior.

Specification and Innovations

Tesla’s ongoing innovation is evident through its Autopilot and Full Self-Driving (FSD) features, leveraging AI to stretch the limits of autonomous capabilities. With each software update, these systems aim to reduce human intervention, improve safety, and offer a seamless driving experience. Tesla’s commitment to continual improvements signals its dedication to leading the next phase of automotive technology.

Market Analysis and Forecasts

Market trends project a significant growth trajectory for AI in the automotive sector. Analysts predict that AI’s role in vehicles will grow exponentially over the next decade, largely driven by advancements in machine learning and data processing technologies. Tesla, as a first-mover, could potentially dominate this market, benefitting from early adoption and customer trust in their innovative technologies.

Pros and Cons

# Pros:

1. Increased Safety: AI enhances real-time decision-making, improving road safety.

2. Efficiency: AI can optimize routes and energy consumption, crucial for electric vehicles.

3. Convenience: Features like Smart Summon offer drivers unmatched ease of access.

# Cons:

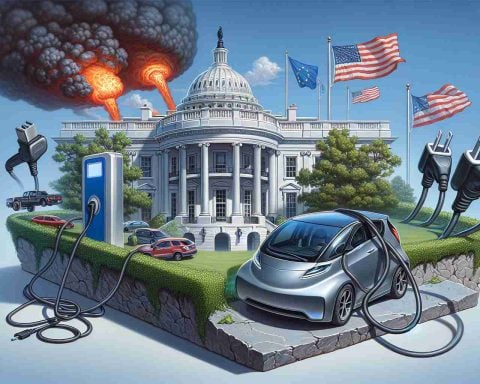

1. Regulatory Challenges: The evolving regulatory landscape can impact the rollout of AI features.

2. High Cost: Developing and implementing AI technologies remain costly, affecting product pricing.

3. Dependency on Software: High dependency on software updates can lead to potential vulnerabilities.

Key Questions Answered

1. How does AI impact Tesla’s valuation?

AI significantly influences Tesla’s market valuation by positioning the company as a tech leader in automotive innovation. With growing investor interest in AI, Tesla’s valuation often reflects its potential rather than its current earnings. By continually advancing its AI capabilities, Tesla aligns itself with future trends, attracting investment and market optimism.

2. What sets Tesla apart from competitors in AI integration?

Tesla distinguishes itself from competitors through its vertically integrated approach to AI technology. Unlike others who rely on third-party software, Tesla develops its AI system in-house, ensuring a seamless integration with its hardware. This control over both hardware and software allows Tesla to rapidly innovate and maintain an edge over its competitors.

3. Are there any industry predictions related to Tesla and AI?

Experts predict that Tesla, leveraging its AI advancements, will play a crucial role in creating a new standard for autonomous transportation. As AI technology matures, the company could expand into new business areas, such as robotaxi services and AI-driven fleet management, broadening its revenue streams.

For more insights into Tesla’s journey and its technological advancements, visit Tesla.