- NVIDIA is experiencing a significant increase in its stock value due to the AI revolution.

- The company’s GPUs and AI accelerators are essential in various sectors, driving demand for its products.

- AI technologies are moving from theory to practice, leading to increased integration and investment.

- The rise in NVIDIA’s valuation signals AI’s potential to redefine market leaders and traditional industries.

- Investors should consider both the opportunities and potential market volatility associated with AI advancements.

In the arena of technology-driven markets, NVIDIA Corporation is witnessing an extraordinary trajectory in its stock value, fueled by the burgeoning artificial intelligence (AI) revolution. The NVIDIA share price has experienced a remarkable surge, captivating the attention of investors globally. But what exactly is driving this surge, and how might this shape future investments?

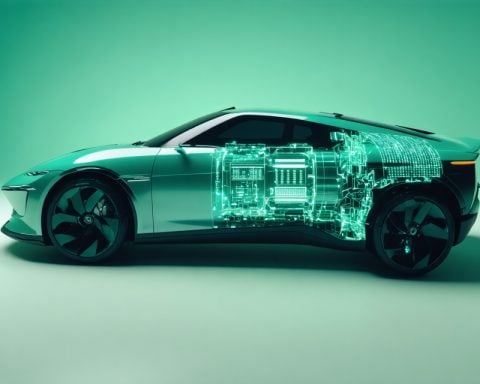

NVIDIA has long been at the forefront of developing high-performance graphics processing units (GPUs) and AI accelerators, critical components that power everything from gaming to data centers. The growing reliance on AI technologies in sectors such as automotive, healthcare, and financial services has significantly boosted the demand for NVIDIA’s products. Furthermore, advancements in AI capabilities have transitioned from conceptual to practical applications, leading to increased investment and integration into everyday technologies.

This rising tide in NVIDIA’s valuation presents an intriguing prospect for future investments, as AI continues to disrupt traditional industries. Analysts predict that this shift underscores an accelerating trend where AI-powered innovation will be pivotal in determining market leaders. As companies race to develop more advanced AI tools, NVIDIA stands as a vital supplier, potentially enhancing its market dominance.

For investors, the surge in NVIDIA’s share price signals more than a mere fluctuation—it points to a broader recognition of AI’s transformative potential. However, potential investors should remain vigilant about market volatility and technological evolution that could affect long-term performance. As AI reshapes our world, NVIDIA’s financial performance could illuminate paths to new investment opportunities, heralding a transformative era in technology markets.

NVIDIA’s Meteoric Rise: Uncovering the Secrets Behind the AI Boom

What Are the Latest Innovations Driving NVIDIA’s Success?

NVIDIA is at the core of technological innovations, particularly with its GPUs and AI accelerators, fueling advancements across different sectors. The company’s latest products, such as the A100 Tensor Core GPUs, are being extensively used in data centers for machine learning tasks. Additionally, NVIDIA’s acquisition of Arm Holdings has positioned it to further drive innovation in AI and other technological domains.

How Is the AI Revolution Impacting NVIDIA’s Market Forecast?

The AI revolution has significantly impacted NVIDIA’s market forecast. Analysts predict continued growth as NVIDIA capitalizes on its technologies catering to AI applications. AI’s integration into areas like autonomous vehicles, robotics, and personalized medicine has opened new revenue streams. The global AI market is estimated to grow at a CAGR of nearly 40% in the next few years, indicating a robust demand for NVIDIA’s products.

What Are the Potential Risks and Limitations of Investing in NVIDIA?

While the upward trajectory of NVIDIA’s stock is promising, potential investors should be aware of certain risks and limitations. Market volatility, regulatory challenges, and the competitive landscape pose significant risks. Furthermore, the rapid pace of technological evolution necessitates continual innovation, and failure to keep up could impact NVIDIA’s market position.

For more information, you might want to explore the company’s official resources on the NVIDIA website. This source offers extensive insights into their latest products and corporate strategies.

Conclusion

NVIDIA’s share price surge underscores the growing impact of AI, with the company playing a pivotal role in technological advancements. While the prospects are exciting, potential investors should conduct thorough analyses considering the market’s inherent risks. As AI continues to redefine industries, NVIDIA’s path is laced with opportunities for growth—and cautionary tales of disruption.