- Super Micro Computer, Inc. has seen an 84% rise in stock value this year amid a digital evolution focused on data and AI.

- The company specializes in high-efficiency servers and networking technologies, including liquid cooling solutions that lower costs by 40%.

- After a stock drop last year due to a short-seller’s claims, Super Micro has regained investor confidence and attracted attention from Goldman Sachs.

- Power scarcity poses a significant challenge for the growing data center industry, with discussions around potential solutions like nuclear energy and repurposing crypto hubs.

- The demand for data centers is driven by hyperscale cloud providers, with energy consumption expected to rise as technology landscapes expand.

- The broader narrative emphasizes the importance of flexibility and innovation in a data-driven economy, suggesting that investors consider AI stocks for potential gains.

Super Micro Computer, Inc. finds itself amidst a digital revolution, driving an astonishing 84% surge in stock value this year. As the world hurtles towards a future where data and AI reign supreme, companies with the keenness to adapt shine brightly. The pulse of modern innovation beats within data centers, powering everything from AI to cloud computing.

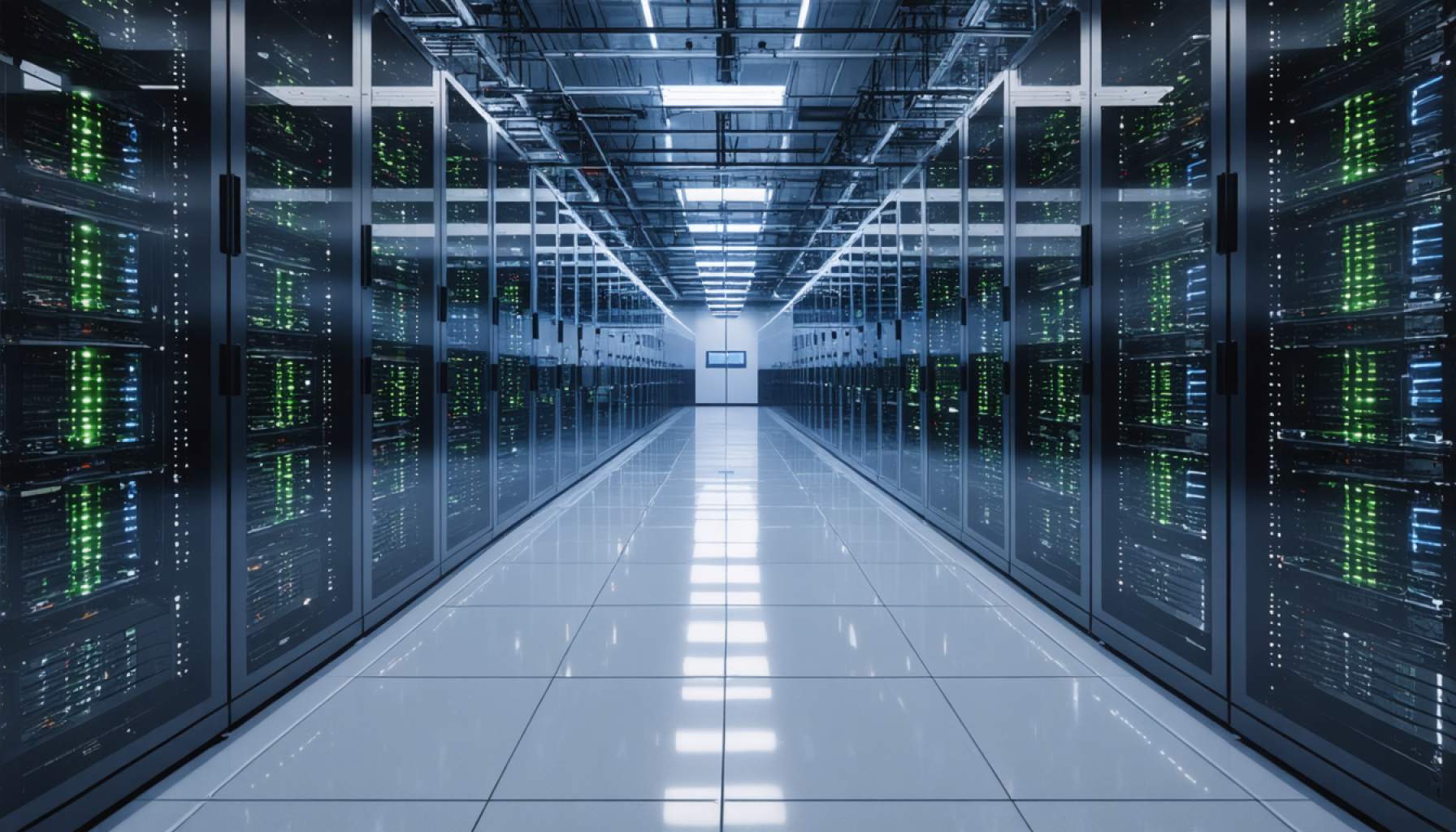

Visualize a bustling server room; the hum of machines echoes the excitement of new possibilities. Super Micro emerges as a key player, crafting high-efficiency servers and networking marvels tailored for data-heavy demands. Their liquid cooling solutions slash costs by 40%, enhancing efficiency—a vital perk in an energy-conscious era.

But this rise is more dramatic considering the dramatic fall just last year. A short-seller’s claims battered the stock, causing a steep drop. Yet, like a phoenix, Super Micro rebounded with remarkable tenacity, regaining investor confidence through timely announcements and strategic recovery steps. Goldman Sachs raised its price target, shedding light on the market’s renewed optimism.

However, the path forward isn’t without hurdles. Experts underline power scarcity as a looming challenge; data centers might face power constraints if growth isn’t matched with solutions. Discussions are ripe with ideas—from embracing nuclear energy to transforming crypto hubs for data needs—as experts seek to navigate the power puzzle.

Hyperscale cloud providers propel this industry ahead, projected to consume more energy as digital landscapes evolve. While Super Micro’s stock story intrigues, the broader lesson is clear: in a data-centric economy, flexibility and innovation remain king. Investors should cast a wide net, perhaps eyeing AI stocks for swift returns, ready to seize the opportunities this digital age unfurls.

Why Super Micro’s Stock Surge Signals a Golden Era for AI and Data Center Innovations

How Super Micro Drives Innovation in Data Centers

Super Micro Computer, Inc. is at the forefront of the digital transformation that is reshaping industries globally. Their stock’s astounding 84% spike this year underscores an increased demand for robust data center solutions—especially those that cater to artificial intelligence (AI) and cloud computing.

Key Features and Innovations

– High-Efficiency Servers: Engineered for optimal performance, these servers address data-heavy operations critical for AI-driven tasks and extensive cloud operations.

– Liquid Cooling Technologies: By implementing advanced cooling solutions, Super Micro cuts energy costs by up to 40%. This is particularly significant in reducing carbon footprints and aligning with sustainability goals.

Real-World Use Cases

1. AI Model Training: High-performance servers enable faster training times for AI models, improving research and development in machine learning significantly.

2. Cloud Service Enhancement: Super Micro’s solutions are being leveraged by hyperscale cloud providers to ensure uninterrupted service and scalability.

3. Financial Services: Data-heavy operations in banking and finance benefit from these efficient systems, leading to quicker transaction processing and analytics.

Market Trends and Future Forecasts

The global data center market is on a rapid upward trajectory, with hyperscale providers demanding more energy-efficient and powerful servers. According to a report by MarketsandMarkets, the data center market is expected to grow from $220 billion in 2021 to $320 billion by 2025.

Industry Trends

– Increased Power Needs: As digital landscapes evolve, the demand for power-efficient technologies is escalating. Super Micro’s innovation in liquid cooling is a significant response to this trend.

– Edge Computing: The rise of edge computing, which processes data closer to the source rather than sending it to centralized data centers, benefits from Super Micro’s high-efficiency servers.

Pros and Cons Overview

Pros

– Energy Efficiency: Significant cost savings and reduced environmental impact.

– Resilience and Recovery: Rapid rebound from stock downturns reflects robust management and strategic vision.

Cons

– Power Supply Challenges: The potential scarcity of energy sources for data centers could impact future growth.

– Market Volatility: As seen with previous short-seller attacks, the market can remain volatile.

Controversies and Limitations

– Short-Seller Impact: Previous claims from short-sellers caused a notable dip in stock value, highlighting potential vulnerabilities to market sentiment.

– Power Dependence: With growing energy requirements, reliance on sustainable energy solutions is paramount but also challenging.

Actionable Recommendations

1. Diversify Investments: While Super Micro shows potential, investors should diversify within technology and AI stocks to spread risk.

2. Stay Informed: Keep abreast of industry developments and energy solutions being explored for data centers.

3. Sustainability Focus: Companies investing in renewable energy and innovative cooling solutions are likely to enjoy long-term benefits.

For more information on data center solutions and innovations, visit the main domain of Super Micro.

By leveraging their strengths and preparing for future challenges, Super Micro and similar companies can lead the way in the burgeoning data-driven economy.