- Trump’s interest in making Canada the 51st state is tied to the U.S. desire for access to Canada’s rare earth elements.

- Canada’s rich mineral deposits, including cobalt and nickel, are crucial for the electric vehicle industry.

- The automotive industry is opposing Trump’s suspension of a $5 billion EV infrastructure funding program.

- There are concerns that halting EV funding could significantly impede the transition to electric vehicles in the U.S.

- The ongoing geopolitical dynamics highlight the critical nature of resource control in the tech-driven economy.

A whirlwind of political maneuvers is shaking the North American automotive landscape as President Donald Trump eyes Canada’s wealth of natural resources. In a stunning twist of geopolitics, reports suggest that Trump is keen on making Canada the 51st state, a move motivated by the nation’s abundant rare earth elements, crucial for electric vehicle batteries and cutting-edge technology.

Prime Minister Justin Trudeau quietly hinted at this ambition during a business summit, acknowledging Trump’s intentions could stem from the U.S.’s desire to tap into Canada’s rich deposits of minerals like cobalt and nickel. With talk of imposing hefty tariffs and threats to absorb the nation, Trump’s strategy is clear: control the resources to fuel America’s tech revolution.

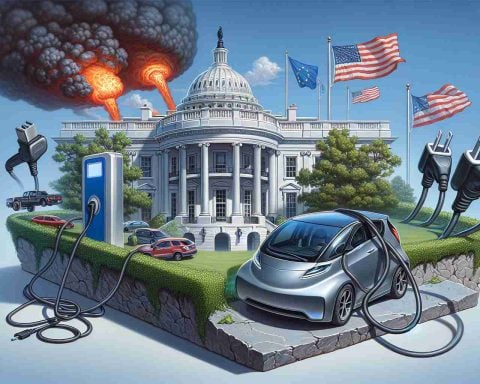

On another front, the electric vehicle market is in turmoil as the auto industry fights back against Trump’s push to suspend funding for essential EV infrastructure. Major automotive players are rallying to restore a critical $5 billion program supporting the installation of EV chargers across the nation. This funding halt could derail the U.S.’s transition to electric vehicles, igniting industry outrage and potential legal challenges.

As the uncertainty looms over steel and aluminum tariffs adding further financial strain, the question remains: What’s next for the auto sector and our friends north of the border? This geopolitical saga underscores the importance of resource control in today’s tech-driven world – and the stakes have never been higher.

Shocking Geopolitical Moves: Is Canada the Next State?

The North American automotive landscape is undergoing significant changes driven by geopolitical maneuvering, particularly with President Donald Trump’s potential ambitions regarding Canada. With a keen interest in Canada’s vast natural resources, especially rare earth elements essential for electric vehicle (EV) batteries and advanced technology, this political shift could alter the trajectory of the automotive industry.

Prime Minister Justin Trudeau has acknowledged the U.S. interest in Canada’s rich deposits of cobalt and nickel, vital for the burgeoning EV sector. Trump’s administration is considering a move that would impose substantial tariffs and possibly absorb Canada as the 51st state. This strategy seems aimed at gaining control over critical resources to propel America’s tech-driven economy.

Key Insights and Trends

– Electric Vehicle Market Impact: The automotive industry is fiercely resisting Trump’s proposed suspension of a critical $5 billion program for EV infrastructure. This suspension threatens to hinder the transition to electric vehicles in the U.S., which is crucial for combating climate change and promoting clean energy vehicles.

– Resource Control and Geopolitics: The current political landscape highlights the significance of natural resources in global power dynamics. Access to vital minerals will not only influence national security but also define competitive advantages in technology and automotive sectors.

– Automotive Industry Reactions: Major players in the automotive sector are rallying against the proposed funding cuts, which could lead to mass legal challenges if the government moves forward with its plans without industry consultation. The support for EV infrastructure is seen as crucial to meet future energy demands and sustainability goals.

Pros and Cons of Trump’s Geopolitical Strategy

Pros:

1. Resource Accessibility: Increased access to Canada’s rare earth materials could bolster U.S. manufacturing capabilities.

2. Economic Growth: A unified North American economic strategy could enhance GDP growth through collaborative efforts.

Cons:

1. Political Tensions: The move could escalate tensions between the U.S. and Canada, straining diplomatic relations.

2. Industry Backlash: The automotive sector’s negative response may create economic instability and lead to legal ramifications.

Future Predictions and Market Analysis

The drive towards electric vehicles is expected to disrupt traditional automotive markets. Analysts predict:

– Growth of EV Market: The demand for electric vehicles will surge, necessitating an increase in production and infrastructure, potentially leading to a broader consolidation in the auto industry.

– Shift in Trade Policies: If tariffs are imposed, we may see shifts in trade agreements and partnerships, notably between the U.S. and Canada, impacting the market landscape.

Frequently Asked Questions

1. What are rare earth elements, and why are they important?

Rare earth elements are a group of 17 minerals crucial for manufacturing high-tech products, including electric vehicle batteries, smartphones, and renewable energy technologies. Their availability directly impacts technological advancement and energy sustainability.

2. How might tariffs on Canadian minerals affect the automotive industry?

Imposing tariffs could significantly increase the cost of raw materials for automakers, which would likely be passed on to consumers, potentially slowing down EV adoption due to higher vehicle prices.

3. What actions can the automotive industry take in response to these geopolitical maneuvers?

The automotive industry can lobby against tariffs, form alliances to collectively push for infrastructure funding, and invest in domestic alternatives to reduce reliance on foreign minerals by developing new mining operations or recycling technologies for battery components.

For more information, visit AutoTrader for insights on automotive trends and forecasts.