- Tesla shares are highly volatile yet appealing for speculative investments.

- AI integration in Tesla’s operations is reshaping the automotive industry.

- The company goes beyond enhancing driving experiences; it transforms vehicle interaction.

- Tesla’s pioneering AI advancements could influence future tech ecosystems.

- Investing in Tesla may represent a stake in the future of tech infrastructure.

- Tesla leads in blending AI with transportation, impacting autonomous living concepts.

- Interest in Tesla shares is growing among stock market enthusiasts and tech advocates.

In the fast-paced world of tech investments, Tesla shares have often been characterized by their volatility and speculative appeal. However, beyond just their financial fluctuations, they are intertwined with a groundbreaking transformation in emerging technologies—particularly in artificial intelligence (AI) integration within the automotive industry.

While traditional automakers adapt to the electric vehicle (EV) shift, Tesla is pushing boundaries by embedding AI into its core operations. This is not merely for enhancing the driving experience with its self-driving capabilities; it’s about reimagining how vehicles interact with the environment and the consumer. The ambitious integration of AI through sophisticated software updates positions Tesla as a de facto tech company.

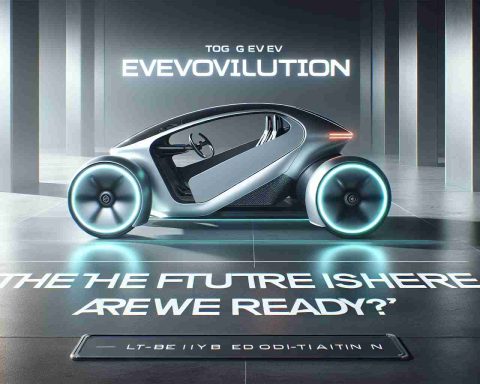

This AI push is poised to do more than change transport—it stands to alter consumer technology preferences. Unlike other car manufacturers who are still catching up, Tesla’s pioneering advancements in AI could dictate future tech ecosystems where everything from energy consumption habits to smart home integration interfaces with our vehicles.

For investors, this means that buying Tesla shares could be seen not just as a stake in an automaker, but a slice of the future tech infrastructure. As Tesla leads in blending transportation with cutting-edge AI, its shares symbolically represent a shift towards autonomous, interconnected living—an emerging perspective changing how we perceive automobiles and technology’s role.

As these innovations unfold, the potential for Tesla shares to fuel the next tech revolution is becoming increasingly clear, galvanizing interest from not just stock market veterans but tech evangelists as well.

Tesla’s AI Revolution: The Investment Strategy of the Future

How is Tesla Revolutionizing AI in the Automotive Industry?

Tesla is not just adapting to the shift towards electric vehicles; it is redefining the automotive landscape with its groundbreaking AI integration. The company uses AI to enhance self-driving capabilities, but its ambitions extend beyond autonomous driving. Tesla’s AI is designed to create a seamless interaction between vehicles, the environment, and consumers, potentially reshaping consumer technology preferences.

Tesla’s approach to AI includes frequent over-the-air software updates which improve safety, efficiency, and the overall user experience, distinguishing it from traditional automakers. This innovative approach positions Tesla as a leader not only in the EV market but as a harbinger of the larger interconnected tech ecosystem.

What Are the Key Pros and Cons of Investing in Tesla Shares?

Pros:

1. Innovation Leader: Tesla’s advanced AI and self-driving technology can potentially dominate future automotive and tech markets.

2. Tech Integration: The company’s focus on a tech-driven automotive experience attracts tech enthusiasts and investors seeking future-forward companies.

3. Environmental Impact: As a pioneer in electric mobility, Tesla aligns with global sustainability trends, appealing to eco-conscious investors.

Cons:

1. Market Volatility: Tesla shares have historically been volatile, influenced by market speculation and rapid industry changes.

2. Regulatory Risks: As AI in autonomous vehicles is a rapidly developing field, regulatory hurdles can impact Tesla’s operations.

3. Competition: Traditional automakers and new entrants in the EV market are constantly innovating, creating intense competition.

What Are the Trends and Predictions for Tesla’s Future in AI and Tech Integration?

Trends:

– Growing Demand for Integrated Tech: Consumers are increasingly demanding smart features that connect their vehicles with home and work environments.

– Sustainability: There is growing global attention on sustainability, benefiting Tesla’s all-electric vehicle line-up.

– AI Advancements: Continuous advancement in AI technologies, such as machine learning and data analytics, is likely to enhance Tesla’s self-driving capabilities.

Predictions:

– Tesla may continue to lead not just as an automaker but as a cornerstone of tech innovation.

– The integration of Tesla’s vehicles with smart home ecosystems and renewable energy solutions could revolutionize how consumers interact with technology daily.

– Market predictions suggest a potential increase in Tesla’s market share as more consumers and investors recognize the strategic value of tech integration within the automotive industry.

As you consider investing in Tesla or exploring more about their innovative approaches, visit these relevant links for further insights:

– Tesla