- China’s policies and subsidies are driving a major increase in electric vehicle (EV) sales, impacting global lithium demand.

- Lithium prices may rebound by 2025, spurred by reduced mining operations and a cut in surplus by 50%.

- China sold five million EVs by the end of last year, demonstrating a strong commitment to clean energy.

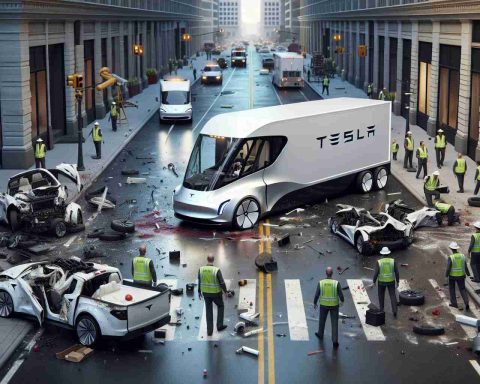

- The U.S. faces potential reductions in tax credits and strained relations with China, which could dampen lithium demand.

- Strategic policymaking and innovation are crucial for steering the world towards a sustainable, electrified future with lithium as a cornerstone.

A quiet revolution stirs beneath the electric hum of China’s burgeoning vehicle industry, promising to reshape the global lithium landscape by 2025. As the world tiptoes toward an electrified future, the tectonic shifts in China’s policy corridors are orchestrating what might become a remarkable rebound for lithium prices.

Chinese markets, buoyed by amplified electric vehicle (EV) subsidies, gallop ahead, casting long shadows over global lithium demand projections. With subsidies doubled last July, China witnessed a staggering five million EV sales by year’s end. This surge not only highlights the nation’s commitment to clean energy but also signals a dramatic easing of the lithium glut caused by recent oversupply—an issue that has sent prices plummeting by 86% since November 2022.

Analysts foresee 2025 as a pivotal year, where curtailed mining operations, coupled with a drop in surplus by 50%, could finally lift lithium prices from their slumber. While China charges forward, crafting a fertile ground for EV proliferation through supportive policies and infrastructure advancements, the story unfolds differently across the Pacific.

In the United States, whispers of reduced tax credits and ongoing tensions with China loom like storm clouds, threatening to curtail lithium demand. Yet, amidst the uncertainty, one fact remains unchallenged: The world is swiftly pivoting towards sustainable energy solutions, with lithium as its cornerstone.

The tale of lithium’s revival is a testament to the power of strategic policymaking and innovation. As EV technologies evolve, so too must the strategies that embrace this transformation, steering the world closer to a sustainable, electrified future. The message is clear: the path to a green horizon is paved with lithium, and its journey is just beginning.

Lithium’s Global Impact: How China’s Strategy Could Shift the Market by 2025

How China is Influencing the Global Lithium Market

China’s significant investments and policies in the electric vehicle (EV) sector are drastically reshaping the global lithium market. By doubling EV subsidies, China anticipates selling five million EVs by the end of the year, which underlines its dedication to clean energy. This move has eased the excess supply in the lithium market, helping recover prices that have plummeted by more than 85% in the past year.

The Pros and Cons of Rising Lithium Demand

Pros:

1. Increased EV Adoption: Boosting the demand for lithium will drive innovation and development within the EV industry, accelerating the transition to renewable energy.

2. Economic Growth: As demand rises, countries with lithium reserves may experience economic growth, thereby strengthening their position in the global market.

Cons:

1. Environmental Concerns: Increased lithium extraction has significant environmental impacts, including habitat destruction and water supply contamination.

2. Market Volatility: The dependency on China’s policies and demand could lead to market volatility, affecting global prices unpredictably.

Market Forecasts and Predictions

Analysts predict that by 2025, a reduction in mining operations and a significant decrease in the surplus—by around 50%—will help stabilize and elevate lithium prices. China’s aggressive strategy in reducing oversupply indicates a potential stabilization of the market, benefitting lithium producers worldwide.

Comparisons: China vs. The United States

While China is pushing forward with aggressive EV subsidies and policies, the United States is facing challenges that may dampen lithium demand. Possible reductions in tax credits and geopolitical tensions with China could shift the competitive landscape between the two nations.

Innovations and Features in Lithium Technology

Recent advancements in lithium technologies, such as improved battery efficiencies and recycling methods, are revolutionizing the industry. These innovations not only enhance the lifespan and capacity of lithium batteries but also reduce the environmental impact associated with traditional mining.

Market Analysis and Sustainability

The drive towards sustainable energy heavily depends on the lithium market’s ability to supply the growing demand efficiently. Sustainability initiatives are key to mitigating the environmental impacts of lithium extraction, with companies investing in cleaner mining technologies and recycling processes.

Questions and Insights

– How will China’s policies impact global lithium prices long-term?

China’s strategic policymaking could stabilize global prices, but significant market dependency on China’s policy climate poses risks of volatility.

– What are the environmental impacts of increased lithium demand?

The extraction processes can result in significant environmental degradation, highlighting the need for sustainable practices.

Suggested Link

For more information on global market trends and insights, visit Bloomberg.

By understanding these dynamics, stakeholders in the lithium market can better navigate the industry’s future, ensuring that the path to a sustainable and electrified future remains clear and steady.