- Lei Jun has become the fifth richest billionaire in China with a net worth of $35.3 billion, driven by a 250% increase in Xiaomi’s stock value.

- Xiaomi’s shares have jumped 130% this year, significantly outperforming the market benchmark, attracting investor enthusiasm.

- With a focus on high-end smartphones and an ambitious EV strategy, Xiaomi plans to produce 300,000 vehicles by 2025.

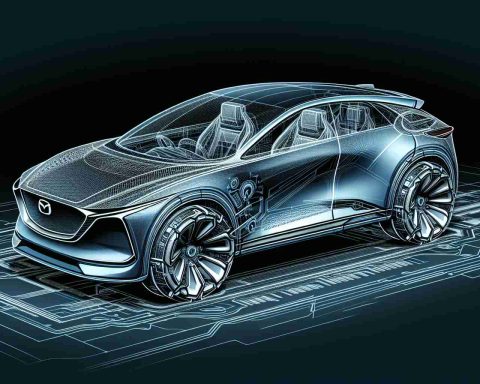

- The recent launch of the SU7 sedan and the upcoming YU7 SUV positions Xiaomi to compete with established brands like Tesla.

- Despite the optimism, caution is advised due to the stock’s high valuation at 53 times earnings, though growth potential remains strong.

In a stunning turnaround, Lei Jun, the mastermind behind Xiaomi, has skyrocketed to be the fifth richest billionaire in China, amassing a staggering $35.3 billion. This surge comes after Xiaomi’s shares soared by 250% over the past year, thrilling investors with promises of a bright future in electric vehicles (EVs).

At the helm of the Hong Kong-listed tech giant, Lei has seen his fortune swell from just $10.9 billion earlier this year to its current eye-popping value. The company’s shares have not only surged 130% this year but have also outperformed the benchmark index handily, further fueling investor enthusiasm. A significant contributor to this rally is Xiaomi’s burgeoning smartphone line, which has shifted towards more lucrative high-end models.

Xiaomi is making bold moves in the EV market, aiming to deliver 300,000 vehicles by 2025. With the recent unveiling of the competitively priced SU7 electric sedan and the upcoming launch of the YU7 SUV, the company is positioned to challenge notable players like Tesla and other premium brands, capturing the interest of China’s youth through stylish designs and Lei’s charismatic presence on social media.

While investors remain optimistic about Xiaomi’s growth, caution is suggested as the company’s stock trades at a high 53 times its earnings. However, analysts point towards the potential for rapid growth in a tech-driven market, with hopes for profitability in its EV division by 2026.

Takeaway: As Xiaomi revs up its EV ambitions and taps into a lucrative tech market, Lei Jun’s journey is a thrilling testament to innovation and opportunity in the fast-paced world of technology.

Will Xiaomi’s Electric Vehicles Outperform Tesla? Insights into the Future

Xiaomi’s recent ascent in both the tech and electric vehicle (EV) markets has left many industry watchers contemplating the company’s future trajectory. With Lei Jun at the helm, the company is embarking on a bold journey to become a significant player in the EV sector, in addition to its already strong smartphone business. Here, we explore some key aspects of Xiaomi’s strategies and market positioning.

New Insights and Trends

– Market Forecasts: Analysts predict that the global EV market will grow at a compound annual growth rate (CAGR) of about 22% from 2022 to 2030, significantly bolstered by China’s aggressive adoption of electric vehicles and favorable government policies.

– Innovations: Xiaomi is reportedly investing heavily in battery technology, aiming to develop more efficient lithium-silicon batteries that could provide longer ranges and faster charging times, positioning itself strongly against competitors like Tesla.

– Sustainability: The company plans to integrate sustainable practices into its manufacturing processes, aligning with increasing consumer demands for environmentally-friendly products.

Comparisons and Features

When comparing Xiaomi’s upcoming electric vehicles like the SU7 sedan and YU7 SUV to established brands like Tesla:

– Pricing: Xiaomi aims to offer competitive pricing for its EVs, potentially undercutting Tesla’s models, which could attract cost-sensitive consumers in a rapidly growing market.

– Technology Integration: Xiaomi plans to incorporate its smart home technology into its vehicles, promoting an ecosystem approach that could enhance user experience beyond just transportation.

Limitations and Challenges

Despite its optimistic outlook, Xiaomi faces several challenges:

– Market Saturation: The EV market is becoming increasingly crowded, with numerous players, from traditional automakers expanding to new entrants, which raises the competitive stakes.

– High Valuation Concerns: The current stock valuation reflects high growth expectations, which could become a liability if the projected growth does not materialize or if there are delays in product rollouts.

Frequently Asked Questions

Q1: How does Xiaomi plan to finance its EV ambitions?

A1: Xiaomi has allocated a significant portion of its revenue and is also pursuing partnerships and potential investments to bolster its EV development funding. The company may tap into the substantial funds raised from its strong smartphone sales and public offerings to support its EV program.

Q2: What makes Xiaomi’s EVs appealing to the young consumers?

A2: Xiaomi targets the youth demographic through stylish designs, advanced technology features, and competitive pricing. Furthermore, Lei Jun’s dynamic presence on social media enhances the brand’s relatability and engagement among younger consumers.

Q3: When can we expect Xiaomi’s EV offerings to start generating profits?

A3: Analysts expect Xiaomi’s EV division to potentially become profitable by 2026, assuming the company can scale production effectively and capture significant market share in a competitive landscape.

Takeaway

As Xiaomi navigates the intricate landscape of the tech and EV sectors, it holds both lucrative opportunities and formidable challenges. With Lei Jun’s leadership, the company is not just aiming to replicate its smartphone success in the EV market but is also poised to innovate at every turn in a rapidly evolving industry.

For more insights on technology and EV trends, visit Xiaomi’s Official Page.