- The electric vehicle market is witnessing strong growth, with U.S. sales reaching 1.3 million units, a 7.3% increase.

- Despite Tesla’s slight sales decline, global EVs now account for about 20% of total vehicle sales.

- Rivian Automotive could be a promising investment due to its upcoming mass-market models and strong customer satisfaction, despite financial losses.

- Lucid Group presents growth potential with new model launches, yet has a higher valuation that may deter some investors.

- The EV sector offers diverse opportunities for investors: Rivian for value and Lucid for rapid growth.

As the electric vehicle (EV) revolution accelerates, 2024 has highlighted both challenges and opportunities. While Tesla saw a slight dip in sales for the first time in over a decade, with a 1% annual decline, the broader market is buzzing with excitement. EV sales in the U.S. hit a historic peak of 1.3 million units, reflecting a robust 7.3% growth even amidst fears of decline. Globally, electric cars now represent around 20% of all vehicle sales.

So, which stocks are worth your attention?

Rivian Automotive stands out as a captivating choice. Despite being a small player with revenues under $5 billion, Rivian has shown it can create desirable vehicles, achieving top-notch customer satisfaction ratings. However, it’s struggling financially, burning through over $1 billion last quarter. Still, the impending release of three new mass-market models in 2026, all priced below $50,000, could unleash a surge in sales and steer the company toward profitability. Currently trading at a mere 2.8 times sales compared to Tesla’s lofty valuation, Rivian’s potential is hard to ignore.

For those chasing maximum growth, Lucid Group offers an intriguing alternative. Although its sales are significantly smaller than Rivian’s, Lucid’s recent launch of the Gravity SUV has set the stage for explosive growth, with sales soaring by 50% in January alone. However, its valuation at 9.2 times sales raises some eyebrows.

In summary, if you’re navigating the EV landscape, keep an eye on Rivian for long-term value and Lucid for rapid growth potential. The future is electric—are you ready to invest?

The Electric Future: Stocks to Watch in 2024’s EV Market Revolution

As the electric vehicle (EV) market continues to evolve in 2024, several fresh insights can help investors and enthusiasts alike understand the ongoing trends and opportunities. This year has already showcased significant advancements in technology, market dynamics, and consumer preferences in the EV sector. Here’s an exploration of new dimensions around EVs that were not covered in the original article.

Key Trends and Innovations in the EV Market

1. Battery Technology Advancements: Innovations in battery technology are expected to drastically reduce charging times and increase the range of electric vehicles. Companies like QuantumScape are pioneering solid-state battery technologies which promise to decrease range anxiety for consumers, making EVs more attractive.

2. Charging Infrastructure Expansion: The U.S. government’s commitment to investing billions in EV charging infrastructure reflects a strong push to address the “range anxiety” issue. By 2024, there are plans to install more than 500,000 charging stations nationwide, significantly increasing accessibility.

3. Sustainability and Recycling Initiatives: The sustainability aspect of electric vehicles is gaining traction. As the market grows, so does the importance of recycling EV batteries. New legislation and innovative recycling technologies are being implemented to mitigate environmental impact, creating opportunities for companies involved in battery recycling.

Frequently Asked Questions

Q1: What are the long-term growth prospects for Rivian and Lucid in the EV market?

A1: Rivian’s launch of affordable mass-market models by 2026 positions it well for long-term growth, especially as consumer demand for more accessible EVs rises. Conversely, Lucid’s focus on the luxury segment may yield rapid short-term growth. However, competition in the luxury space is intense, so consistent innovations and customer retention will be vital.

Q2: How does the global market compare to the U.S. EV market in 2024?

A2: Globally, EVs account for approximately 20% of all vehicle sales, suggesting a robust international demand. However, the U.S. market remains pivotal, with EV sales peaking at 1.3 million units in 2024, indicative of a rapidly growing consumer base. The interplay between regulations, incentives, and consumer acceptance will likely dictate market trajectories in both regions.

Q3: Are there any emerging competitors to watch in the EV space?

A3: Yes, companies like Fisker Inc. and BYD are emerging as notable competitors. Fisker is known for its commitment to sustainability with its Ocean SUV, while BYD has established itself as a robust player in the global market, capitalizing on both electric passenger and commercial vehicle segments.

Insights and Market Analysis

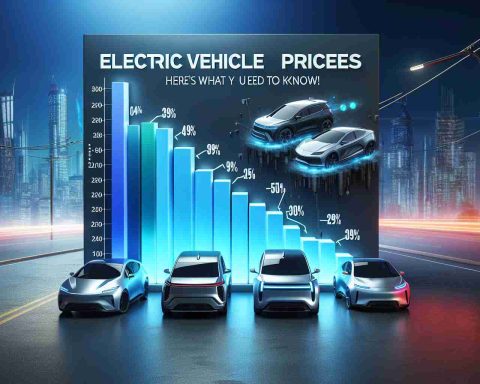

– Pricing Trends: Affordable models are becoming increasingly important as consumers look for budget-friendly options in the EV market. Automakers are recognizing the need to balance quality with affordability to reach a broader audience.

– Security Aspects: Cybersecurity in EVs is a growing concern. As vehicles become more connected, the risk of cyber attacks increases. Companies are investing in advanced security measures to protect consumer data and vehicle functionality.

Suggested Reading

For further insights and updates on the evolving EV market, visit the following link:

Tesla’s Official Site

In conclusion, as 2024 unfolds, the electric vehicle industry is filled with promising opportunities and significant advancements. Keeping an eye on upcoming models, innovations, and market shifts will be crucial for anyone interested in understanding the future of transportation. Are you ready to navigate the electrifying world of EV investments?