- The bankruptcy of Lion Electric poses significant challenges to the Biden administration’s climate initiative.

- The project aimed to deliver electric school buses funded by nearly $160 million in federal support, now jeopardized by Lion’s financial troubles.

- School districts across multiple states are left without promised buses, raising concerns about project reliability.

- Critics highlight inadequate federal vetting of companies before funding, particularly those with substantial financial losses.

- The situation underscores a larger issue of mismanagement within the green energy sector, questioning the effectiveness of federal funding initiatives.

- Overall, the experience stresses the necessity for stronger oversight in energy transition programs to protect taxpayer investments.

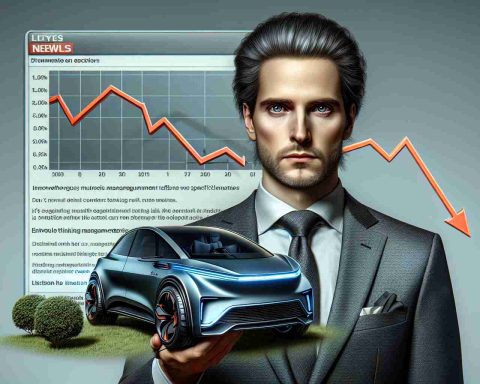

In a dramatic turn of events, the Biden administration’s ambitious climate initiative faces a hard reality as Canadian electric bus manufacturer Lion Electric has plunged into bankruptcy. The ambitious plan, supported by nearly $160 million in federal funds, aimed to deliver hundreds of shiny, battery-powered school buses to districts across the country—but those dreams now hang in the balance.

Just weeks ago, Lion Electric laid off its manufacturing staff and halted production, leaving many school districts, including those in California, Montana, and Iowa, in the lurch. Reports indicate that the company has yet to deliver $95 million worth of promised electric buses to 55 districts nationwide, casting doubt over the reliability of the government-backed project.

As anxiety builds among school officials, the ghost of regulatory mismanagement looms large. Critics question whether federal authorities conducted adequate vetting before showering millions on a company already struggling under the weight of $301.6 million in net losses and cratering stock prices.

Once heralded as a leader in green transportation, Lion’s downturn highlights a troubling trend in the green energy sector—government resources poorly managed and companies collapsing despite early promises of growth.

An investigation into the Clean School Bus program reveals a concerning dependence on federal funding, with an astonishing 67% of planned electric school buses financed by taxpayers. As communities await answers, the fallout serves as a stern reminder of the challenges faced in the transition to sustainable energy.

The key takeaway? While ambitions for a greener future are noble, the execution needs careful oversight to avoid colossal failures that impact local communities and taxpayer money.

Shocking Bankruptcy: The Fallout of Lion Electric’s Collapse and Its Impact on School Transportation

Lion Electric’s Bankruptcy: A Setback for Green Energy Initiatives

Lion Electric, once a beacon of innovation in electric bus manufacturing, recently declared bankruptcy, throwing a significant wrench into the Biden administration’s climate initiative. With nearly $160 million in federal support, the ambitious goal was to provide electric school buses to numerous districts across the United States. However, the abrupt halt in production and the layoff of staff have raised severe concerns regarding the delivery of $95 million worth of buses intended for 55 school districts. The company’s failure not only jeopardizes environmental objectives but also leaves many school districts—particularly in California, Montana, and Iowa—in dire straits.

Key Insights and Current Trends

1. Market Predictions: The electric bus market is projected to grow significantly, reaching an estimated $38 billion by 2030, fueled by rising environmental regulations and a shift towards sustainability in public transportation.

2. Sustainability Challenges: The incident highlights a broader issue within the green energy sector—many companies depend heavily on federal funds. As revealed, 67% of the proposed electric buses were funded by taxpayers, raising questions about long-term sustainability and corporate viability.

3. Security and Reliability Concerns: Following the collapse, school districts are reevaluating their reliance on external contractors. The downturn underlines a pressing need for regulations that ensure sufficient vetting of companies responsible for crucial public services like transportation.

Important Related Questions

1. What are the implications of Lion Electric’s bankruptcy for the Electric Bus Initiative?

Lion Electric’s bankruptcy signifies potential delays in the roll-out of electric buses, straining budgets and forcing school districts to reconsider their transportation plans—possibly leading them back to traditional fuel sources.

2. How will this event affect future federal funding for similar projects?

This incident may lead to stricter guidelines and enhanced scrutiny for companies applying for federal funds, creating a more robust evaluation process to safeguard taxpayer investments.

3. What does the future hold for electric vehicle manufacturers?

Despite setbacks like Lion Electric’s, the broader market for electric vehicles shows optimistic growth signals. Investing in robust corporate practices and innovative technologies will be crucial for companies aiming to remain viable in this competitive landscape.

For more information on sustainable transportation initiatives, visit EPA.

This strategic analysis illustrates the complexities and challenges facing green initiatives, emphasizing the need for careful planning and evaluation as the nation seeks to foster a more sustainable future.