- The Union Budget 2025 introduces a customs duty exemption on capital goods for lithium-ion battery production.

- This initiative aims to boost local manufacturing and strengthen the clean mobility supply chain in India.

- Removing duties on essential raw materials like copper and lithium-ion battery scraps is expected to advance EV growth and recycling.

- The National Manufacturing Mission focuses on innovation in Clean Tech manufacturing, complementing the “Make in India” campaign.

- Industry experts call for expansion of charging infrastructure and stronger incentives for fleet electrification to support EV adoption.

- Existing GST rate disparities on EVs and batteries remain a challenge that could impede production and infrastructure progress.

- Better tax benefits and credit guarantees for SMEs provide optimism for funding in auto-tech startups.

In a game-changing leap for India’s electric vehicle (EV) landscape, the government’s Union Budget 2025 has sparked excitement across the automotive sector. The standout announcement: a customs duty exemption on capital goods for lithium-ion battery production. This crucial move is set to turbocharge local manufacturing, enhancing the nation’s clean mobility supply chain.

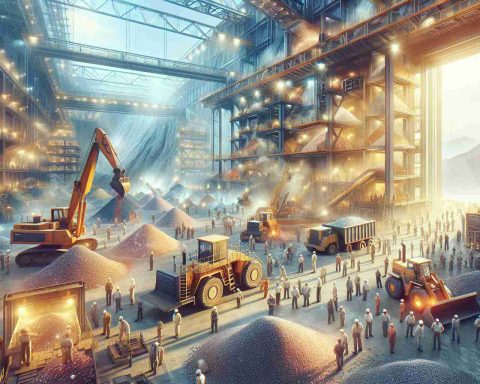

The Automotive Component Manufacturers Association (ACMA) voiced its approval, highlighting that the revamped customs duties on essential raw materials would empower domestic manufacturing, making it more cost-effective. Eliminating duties on materials like copper and lithium-ion battery scraps promises to supercharge India’s EV growth while expanding the recycling of critical minerals.

As part of a broader strategy, the government also unveiled a National Manufacturing Mission to enhance innovation in various sectors, with Clean Tech manufacturing at the forefront. This initiative aligns perfectly with the “Make in India” initiative, aiming to strengthen the country’s manufacturing prowess and competitiveness.

However, industry leaders urge more comprehensive actions. Calls are growing for increased investments in charging infrastructure and more robust incentives to electrify fleets, which are seen as pivotal for accelerating EV adoption and building investor trust.

A lingering issue involves GST disparities, with EVs enjoying a favorable 5% tax, while their batteries face an 18% rate, which could hinder production and infrastructure development.

Despite these bumps in the road, the Budget’s provisions—including better tax benefits and credit guarantees for small and medium enterprises—ignite hope for enhanced financing for auto-tech startups. As India strides confidently toward a greener future, the groundwork is being laid for an electrifying transformation in the EV sector.

India’s Electric Vehicle Revolution: What the New Budget Means for the Future

In a game-changing leap for India’s electric vehicle (EV) landscape, the government’s Union Budget 2025 has sparked excitement across the automotive sector. The standout announcement: a customs duty exemption on capital goods for lithium-ion battery production. This crucial move is set to turbocharge local manufacturing, enhancing the nation’s clean mobility supply chain.

The Automotive Component Manufacturers Association (ACMA) voiced its approval, highlighting that the revamped customs duties on essential raw materials would empower domestic manufacturing, making it more cost-effective. Eliminating duties on materials like copper and lithium-ion battery scraps promises to supercharge India’s EV growth while expanding the recycling of critical minerals.

As part of a broader strategy, the government also unveiled a National Manufacturing Mission to enhance innovation in various sectors, with Clean Tech manufacturing at the forefront. This initiative aligns perfectly with the “Make in India” initiative, aiming to strengthen the country’s manufacturing prowess and competitiveness.

Key Insights and Trends

1. Market Forecast: Experts predict that these budget measures could lead to a 20-25% decrease in battery costs within the next two years, significantly impacting the pricing of EVs.

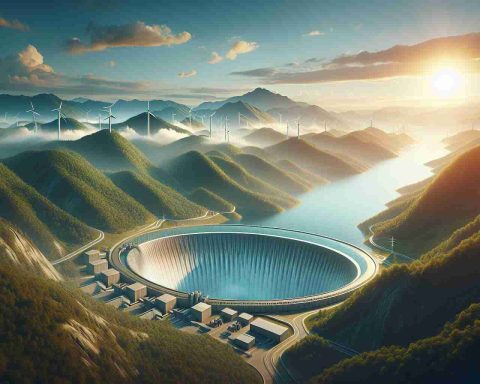

2. Sustainability Aspects: The move towards local battery production is expected to reduce carbon emissions tied to transportation, aligning with global sustainability goals by promoting cleaner manufacturing practices.

3. Charging Infrastructure Development: With the government’s push towards local manufacturing, enhanced investments in EV charging infrastructures are anticipated, which will be vital for supporting the predicted rise in EV adoption.

Pros and Cons of the Budget 2025 Measures

– Pros:

– Boost in local manufacturing capabilities.

– Cost reduction in battery production, leading to more affordable EVs.

– Greater recycling of critical minerals, promoting sustainability.

– Cons:

– Current GST disparities may hamper production and expansion.

– Need for further investments in charging and service stations to support EV growth.

Most Important Related Questions

1. How will the customs duty exemption impact EV prices and adoption rates?

– The exemption is expected to lower production costs for lithium-ion batteries significantly. As battery prices decrease, it is likely that the overall price of EVs will drop, potentially leading to increased adoption rates among consumers.

2. What incentives are being proposed for improving charging infrastructure?

– Industry leaders are advocating for comprehensive incentives including subsidies for charging station installations and tax rebates for companies investing in EV infrastructure, which are crucial for widespread EV adoption.

3. What are the long-term implications of the GST disparities on the EV market?

– If unresolved, the 18% GST on batteries compared to the 5% on EVs could delay production and infrastructure development, potentially slowing down overall growth in the EV sector. Addressing these disparities is crucial for maximizing the benefits of the budget’s new measures.

To explore more about the Indian EV ecosystem, visit the Economic Times for recent updates.

In summary, while the Union Budget 2025 has laid a solid foundation for expanding India’s EV landscape, addressing the remaining challenges will be pivotal in determining the nation’s electrifying transformation towards a greener future.